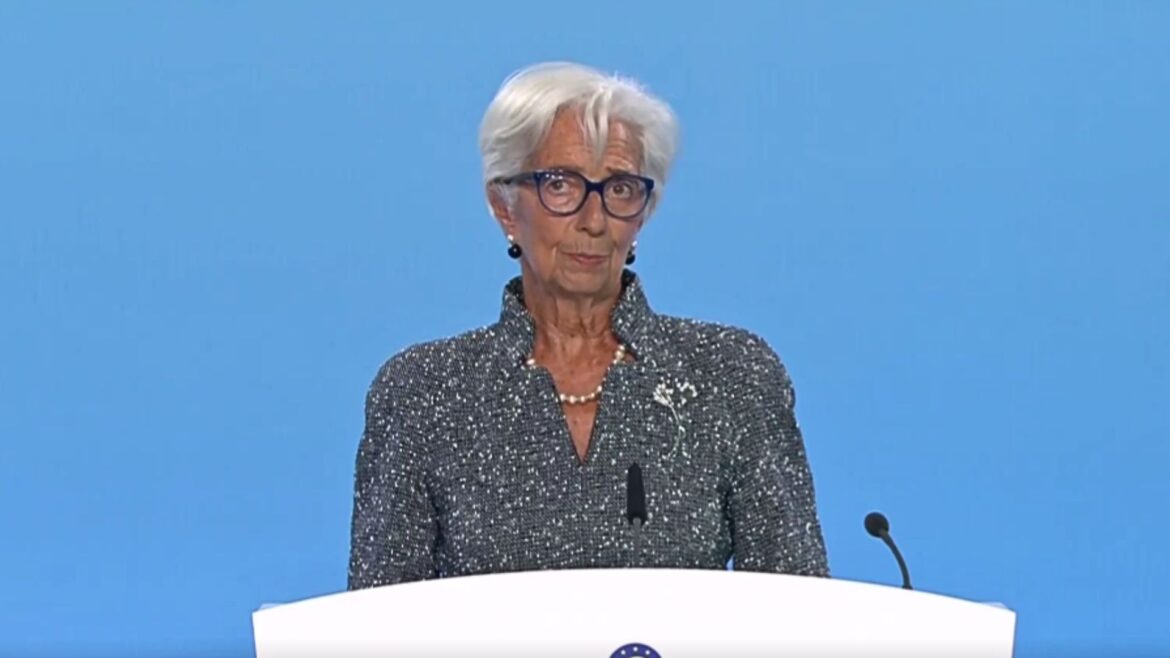

The ECB reduced its deposit rate to 3.5% amid the lowest inflation levels in three years. Despite the slowdown, rising wages in the services sector could reignite inflationary pressures. Economic growth remains sluggish, with ECB President Christine Lagarde warning of ongoing risks to recovery.

The European Central Bank (ECB) has lowered its deposit facility rate by 25 basis points to 3.5%. The Governing Council also cut the rates on the main refinancing operations to 3.65% and the marginal lending facility rate to 3.90%.

This marks the second rate cut by the ECB this year, as the central bank seeks to respond to easing inflationary pressures. In August, inflation fell to 2.2%, its lowest level in three years and edging closer to the ECB’s target of 2%. However, there remains the potential for inflation to rise again due to recent wage increases in the services sector.

«Domestic inflation remains high as wages are still rising at an elevated pace. However, labour cost pressures are moderating, and profits are partially buffering the impact of higher wages on inflation», explained the ECB.

Eurostat reported that inflation has receded primarily due to declining energy costs, although economic growth remains tepid. In the second quarter, the eurozone’s Gross Domestic Product (GDP) grew by 0.2%, falling short of the anticipated 0.3%.

The ECB has emphasized that future policy decisions will depend on the evolution of key economic indicators. «The Governing Council will continue to take a data-dependent, meeting-by-meeting approach to determining the appropriate level and duration of monetary tightening,» the ECB stated.

ECB President Christine Lagarde provided limited guidance on the timing of the next policy adjustment, but she noted that the downward trend in inflation is becoming more apparent.

Lagarde also cautioned that wage volatility is likely to persist in an economic environment still facing significant risks. She added that a less restrictive monetary policy could help bolster investment and consumer spending as the recovery solidifies.

“Inflation is expected to pick up again in the latter part of the year, partly as the burden of past energy price increases fades from annual rates. Inflation should then ease towards our target in the second half of next year. As regards underlying inflation, the projections for 2024 and 2025 have been revised up slightly as services inflation has been higher than expected,” Lagarde said.