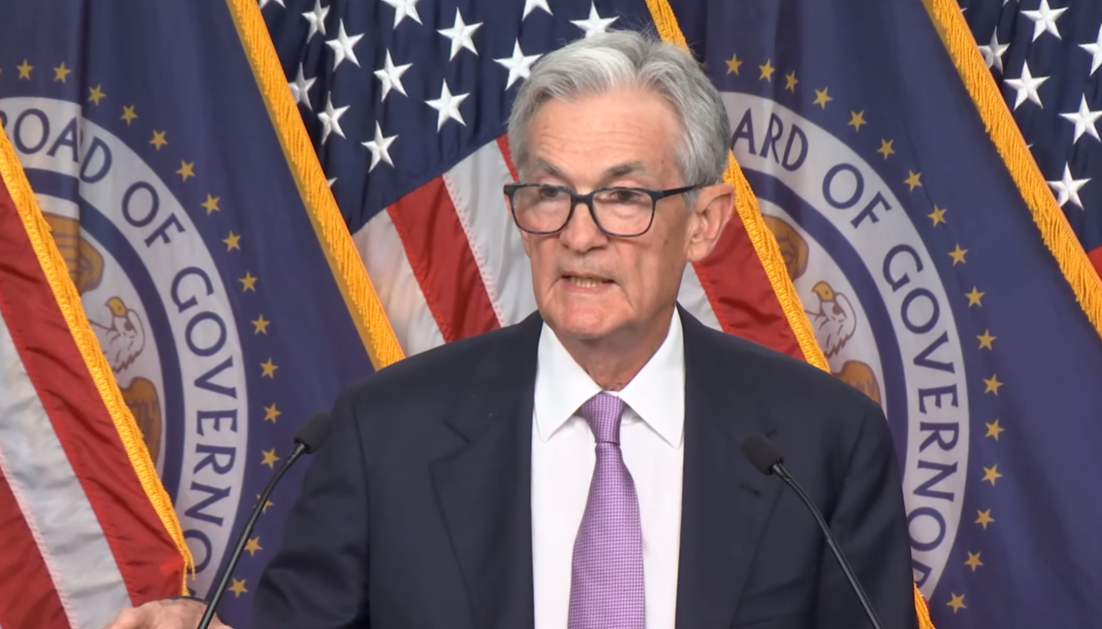

Amid inflation concerns and sluggish labor data, the Fed signals potential further cuts, while Chair Jerome Powell forecasts rates at 4.4% by year-end and 3.4% in 2025.

After four years of holding steady, the Federal Reserve has reduced interest rates by 50 basis points, surpassing market expectations.

Since 2020, the Fed had not made any downward adjustments amid a backdrop of rising global inflation that has affected markets in the wake of the COVID-19 pandemic. Interest rates steadily increased between March 2022 and July 2024, reaching a cumulative 525 basis points.

Following the conclusion of the monetary policy meeting this Tuesday, the Fed acknowledged that while the economy appears to be expanding at a solid pace, concerns remain regarding inflationary pressures and weak labor market data.

The Federal Open Market Committee (FOMC) stated that it will continue monitoring incoming economic data, signaling the possibility of further rate cuts in the coming months.

Jerome Powell, Federal Reserve Chair, projected that if the economy evolves as anticipated, the federal funds rate could stand at 4.4 percent by the end of this year and drop to 3.4 percent by the end of 2025.